Accounting Dashboard Examples & Templates

A modern, integrated financial dashboard also makes it easy for them to drill into the data and gain actionable insights. An accounting dashboard is a dynamic, visual representation of your financial health. It’s a consolidated all you need to know about zero depreciation auto insurance view of key financial metrics that provides actionable insights at a glance. That’s not a difficult figure to find, but pulling together all the balances from multiple accounts can use up time best spent on higher-order tasks. See your current cash balances from all accounts in one financial dashboard, then drill down for more detail.

Without a business intelligence solution you can depend on, keeping track of so many key metrics can seem like an impossible task. With financial dashboards, you can view all of your crucial financial data as it is updated in real time. Many online accounting dashboards offer seamless integration with popular accounting software.

Data Integration and Quality

- Whether you need to review the month’s AP report or confirm balance sheet figures at year’s end, Bold BI can help you achieve your goals.

- This guide provides examples and practical advice to help you move beyond monitoring and reporting and create best-in-class financial dashboards.

- See all opportunities for the current period that haven’t yet been billed.

So everything, from data connection to distribution of your dashboards at any time and on any device, is all business-user friendly. Yes, most online accounting dashboards are cloud-based, allowing you to access them from any device with an internet connection. With Accounting Seed’s simple drag-and-drop functionality and no-code customization, you’ll easily tailor financial dashboards to your processes and accounting workflows. Dig deeper and build crisp, clear financial presentations and real-time reports with user-defined calculations, rows, and columns.

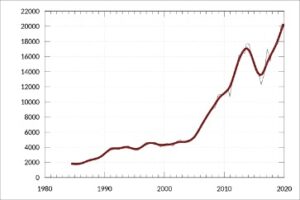

Margin Analysis Dashboard

Here are just a few examples of the departments and industries that use our pre-built templates on a daily basis to improve performance. This Freshbooks dashboard outlines a company’s revenue and expense details, along with their customer growth… Simply drag and drop from a massive library of built-in graphics and other dashboard elements to create custom dashboard views that fit your business. Sales teams and CFOs track billings by accounting period to get a sense of overall workflow and A/R trends. Following billings by month or quarter reveals the company’s growth, declines, or seasonal shifts. Tracking billings by year can highlight deeper work volume trends and opportunities for new development.

Solutions for Finance

Then click through for details to gain insights that can help your teams expand on and learn from your successes. This guide provides examples and practical advice to help you move beyond monitoring and reporting and create best-in-class financial dashboards. Look for tools with robust security measures such as encryption and data maximum rows and columns in excel worksheet protection policies. Delves deeper into the income statement, analyzing revenue, cost of goods sold, operating expenses, and net income. This data can be included in any dashboard it’s not mandatory to create a separate dashboard.

Tracking cash disbursals can give you time to react to potential cash flow troubles. This is among the best financial dashboard examples to closely monitor your operating costs and gain key insights into your general ledger. You can significantly improve your cash flow by tracking the age of all your payables.

With easy-to-parse graphical representations, you can deliver crisp, concise C-suite presentations, and quickly analyze business performance, operational statistics, and sales metrics with very little effort. Now more than ever, businesses face a sea of data points that can make drawing insights time consuming at best and nearly impossible at worst. Financial dashboards are critical for assessing performance and making educated decisions, closing more sales, and reducing customer acquisition costs.

That said, accounting dashboard implementation is now simpler and less expensive than ever before, positioning accounting pros to take advantage of the many benefits they offer. Whether you need to review the month’s AP report or confirm balance sheet figures at year’s end, Bold BI can help you achieve your goals. To get started, check out our financial dashboard examples below to learn more. Following up on unpaid invoices is a common best practice for improving cash flows.

Tracking payables by period can provide a clearer understanding of the volume of work your business does. It can also create a yardstick to make it easier to track other accounting metrics. Viewing payables by year can help your team identify cost trends a beginner’s guide to the accounting cycle and give a clearer picture of business growth over time.

How Can Financial Dashboards Help Make Business Decisions?

All project management dashboard templates come pre-built with some of the most commonly tracked metrics from the most popular financial management tools. Accounting dashboards visualize accounting key performance indicators (KPIs) and help business leaders have easy access, in real-time, to the insights that matter most to the successful management of their organizations. Provides a snapshot of the company’s financial position, including assets, liabilities, and equity. The balance sheet dashboard shows the financial situation at a specific point in time. The top two views provide an overall picture of your quarterly and yearly performance over the past three years—including key financial measures such as net sales, net profit and net profit margin.